Renters Insurance in and around Waterbury

Waterbury renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your personal items and belongings have both sentimental and monetary value. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your stereo to your guitar. Overwhelmed by the many options? That's okay! Mark Shumilla is here to help you evaluate your risks and help pick the appropriate policy today.

Waterbury renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Protect Your Home Sweet Rental Home

Renting a home is the right choice for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

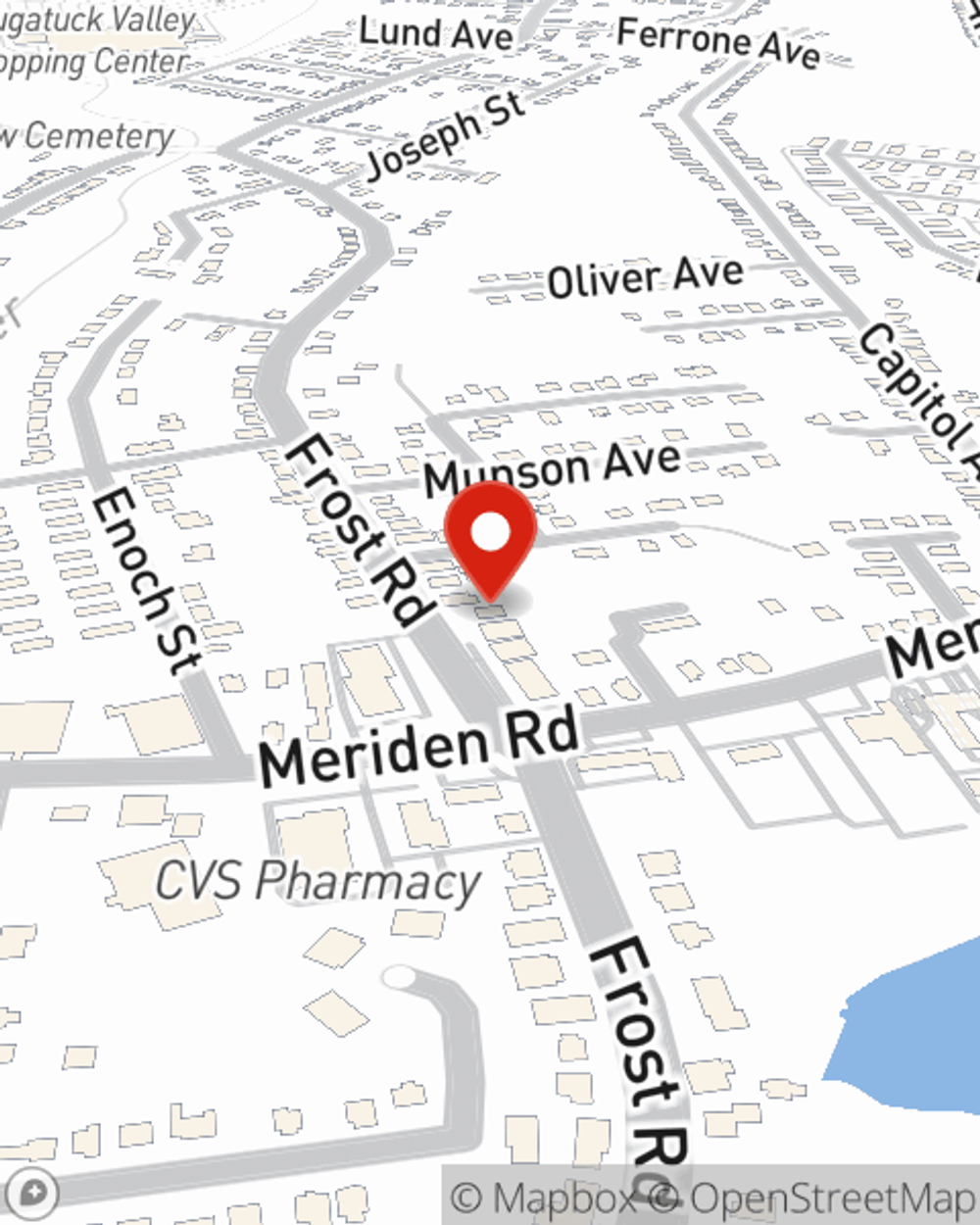

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Waterbury. Get in touch with agent Mark Shumilla's office to talk about a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Mark at (203) 757-6300 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Mark Shumilla

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.